The Government has announced significant revisions to the Coronavirus Business Interruption Loan Scheme (CBILS) that come into effect from Monday 6 April 2020, opening up the scheme to a wider range of businesses.

The Scheme provides UK-based SMEs with turnovers of up to £45 million access to facilities of between £1,000 and £5 million interest-free for 12 months, backed by an 80 per cent guarantee from the Government.

However, until now, CBILS has only been open to businesses that were unable to access a facility on normal commercial terms.

HM Treasury has now confirmed that from Monday 6 April 2020 any businesses that meet the main criteria must be considered for a CBILS facility, even if they would otherwise qualify for a commercial facility.

Am I eligible?

The British Business Banks says that businesses that meet the following conditions must be considered for CBILS:

- Be UK-based in its business activity

- Have an annual turnover of no more than £45 million, of which more than 50 per cent is generated through trading activities

- Have a borrowing proposal which the lender would consider viable, were it not for the current pandemic

- Self-certify that it has been adversely impacted by the coronavirus (COVID-19).

Full details of eligibility and an FAQ link to the British Business Bank can be found here.

What finance can I access?

Funding can be in the form of loans, overdrafts, invoice financing or asset finance, although each lender will be able to choose which elements of the scheme it supports.

Facilities are available from £1,000 to £5 million, subject to a lender’s criteria. CBILS will be interest-free for the first 12 months, as the Government has guaranteed to cover these payments during this period.

The Government and the British Business Bank, which is helping to administer CBIL, have confirmed that no setup fee will be charged.

Am I liable for all of the debt?

The borrower will remain 100 per cent liable for the debt. An 80 per cent guarantee offered by Government is simply to provide some recourse for the lender in the event of a borrower defaulting on their debt.

Do I need to provide a personal guarantee?

The British Business Bank has confirmed that the lender can only require personal guarantees for facilities of £250,000 or more. However, where personal guarantees are required:

- they exclude the Principal Private Residence (PPR), and

- recoveries under these are capped at a maximum of 20% of the outstanding balance of the CBILS facility after the proceeds of business assets have been applied

I’ve previously been turned down for a CBILS facility because I qualified for a commercial loan, can I re-apply?

Yes, the British Business Bank is encouraging businesses in this situation to contact their lender again following the change in the rules.

How do I apply?

The scheme will be delivered through existing commercial lenders, backed by the Government-owned British Business Bank. There are currently 40 accredited lenders able to offer the scheme, but more are being added regularly.

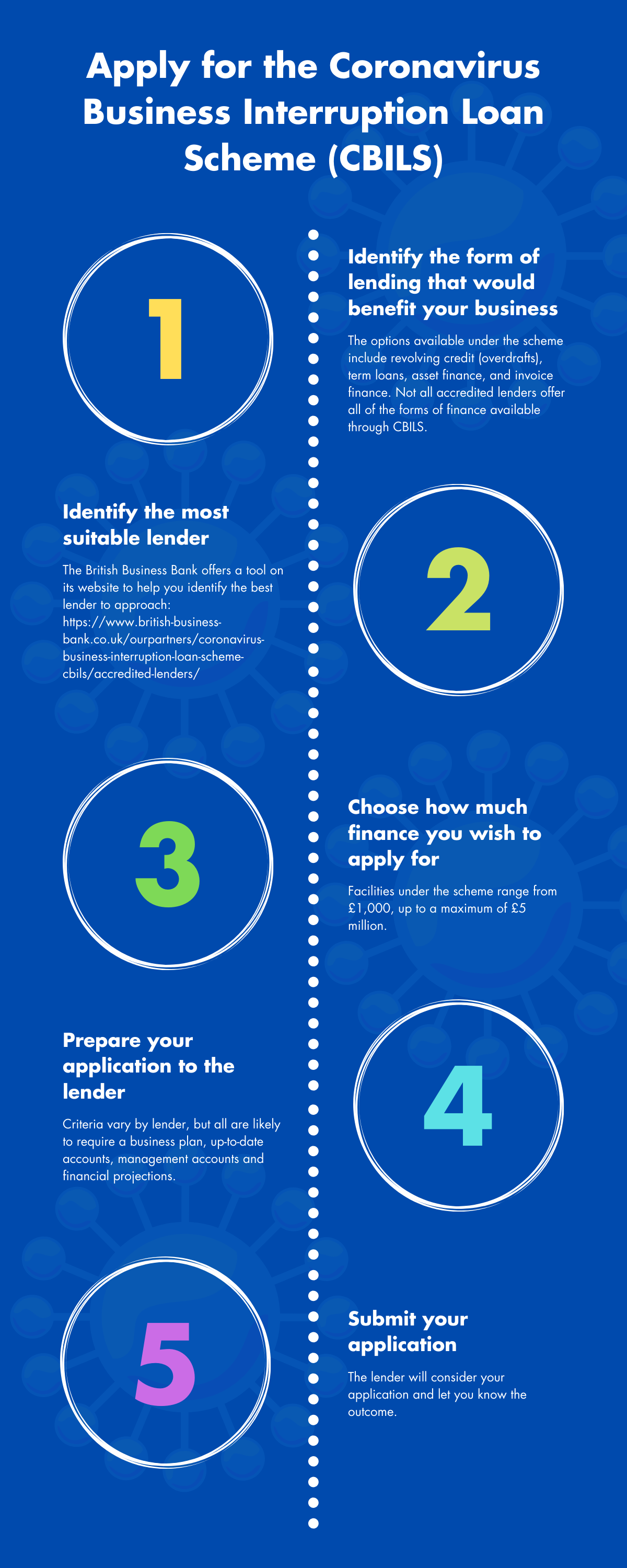

These are the steps that you should take in applying for a loan:

- Decide which form of finance you require and identify which accredited lenders can offer it. This can be done by using the British Business Bank’s filter tool by clicking here.

- This filter allows you to put in the region where your business is based and the type of loan you require and will provide you with a list of suitable lenders.

- Research what each lender is offering via their website and decide how much funding you require.

- Collate all necessary information to make an application, including an up to date business plan, cash flow forecasts, business plans, historic accounts and details of assets.

- Make an application with your chosen lender that suits your requirements. The loan application process is likely to differ from lender to lender.

The British Business Bank has indicated that it may be beneficial to seek finance first through a lender that you have an existing relationship with.

To help you with this process we have prepared a helpful infographic, which can be downloaded and shared.